Real estate is one of the most crucial sectors in any economy. In most countries, it is also one of the largest contributors to GDP. However, the real estate market is not static and is influenced by various factors, including interest rates. When the interest rates increase, it can have a significant impact on the real estate market. In this article, we will discuss the impact of increasing interest rates on the real estate market.

What is an Interest Rate?

Interest rate is the cost of borrowing money or the return on investment paid to an investor. It is expressed as a percentage of the amount borrowed or invested. When interest rates increase, borrowing money becomes more expensive, and the returns on investment increase.

The Relationship between Interest Rates and the Real Estate Market:

The real estate market is influenced by interest rates because of the cost of borrowing money. When interest rates increase, it becomes more expensive to borrow money to buy a home or invest in real estate. Higher interest rates lead to higher mortgage rates, which make it more difficult for people to buy homes. This can reduce the demand for housing, and as a result, the prices of homes may decrease.

Impact of Increasing Interest Rates on the Real Estate Market:

Reduced Demand:

One of the most significant impacts of increasing interest rates on the real estate market is a reduction in demand. Higher interest rates make it more expensive to borrow money, which reduces the number of people who can afford to buy homes or invest in real estate. This reduction in demand can lead to a decrease in the prices of homes and other properties.

Higher Mortgage Rates:

Higher interest rates lead to higher mortgage rates. When mortgage rates increase, it becomes more expensive to finance a home. This can reduce the demand for housing, which can lead to a decrease in home prices.

Slower Construction Activity:

When interest rates increase, it becomes more expensive to borrow money to finance new construction projects. This can slow down construction activity, which can lead to a decrease in the supply of new homes and other properties. A decrease in the supply of new homes and properties can lead to an increase in the prices of existing homes and properties.

Impact on Commercial Real Estate:

Higher interest rates can also impact the commercial real estate market. When interest rates increase, it becomes more expensive for businesses to borrow money to finance real estate projects. This can lead to a decrease in the demand for commercial real estate, which can lead to a decrease in prices.

Impact on Real Estate Investment Trusts (REITs):

Real estate investment trusts (REITs) are companies that own and operate income-producing real estate. They are an investment vehicle for individuals to invest in real estate without owning physical property. Higher interest rates can impact REITs because they rely on borrowing money to finance their investments. Higher interest rates can lead to higher borrowing costs, which can reduce the returns on investment for REITs.

Conclusion:

In conclusion, interest rates have a significant impact on the real estate market. When interest rates increase, it becomes more expensive to borrow money to buy homes or invest in real estate. This can lead to a reduction in demand, higher mortgage rates, slower construction activity, and impact on commercial real estate and real estate investment trusts. It is important to keep an eye on interest rates when investing in real estate or considering buying a home.

Related posts:

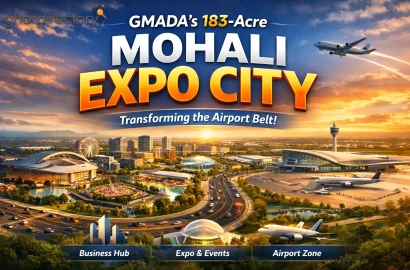

Mohali is set for a major upgrade as GMADA plans a 183 acre Expo City near the airport belt bringing exhibitions, business hubs, jobs and long term investment opportunities to the region.

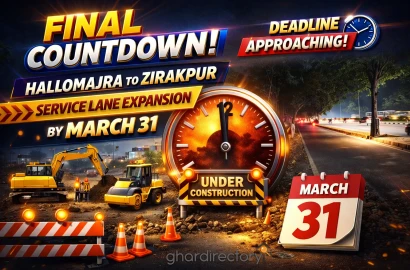

Traffic relief is in sight as the Hallomajra To Zirakpur service lane expansion races toward a March 31 deadline aiming to ease congestion and improve daily commutes.

GMADA’s 183-Acre Mohali Expo City to Transform Airport Belt

GMADA’s 183-Acre Mohali Expo City to Transform Airport Belt

Final Countdown: Hallomajra to Zirakpur Service Lane Expansion by March 31

Final Countdown: Hallomajra to Zirakpur Service Lane Expansion by March 31

Tribune Flyover Nears Reality as Tender Process Enters Final Stage

Tribune Flyover Nears Reality as Tender Process Enters Final Stage

Major Crackdown: Illegal Structures Near Sukhna Lake Demolished

Major Crackdown: Illegal Structures Near Sukhna Lake Demolished

Chandigarh to Auction Prime Plots in Sector 56 Bulk Market This April

Chandigarh to Auction Prime Plots in Sector 56 Bulk Market This April

Add Property

Add Property